Working capital equals the difference between current assets and current liabilities. Organizations need a certain amount of working capital to run their operations smoothly. The optimal (or “target”) amount of working capital depends on the nature of operations and the industry. Inefficient working capital management can hinder growth and performance. Benchmarks The term “liquidity” refers … Read More

News

Using your financial statements to evaluate capital budgeting decisions

Strategic investments — such as expanding a plant, purchasing a major piece of equipment or introducing a new product line — can add long-term value. But management shouldn’t base these decisions on gut instinct. A comprehensive, formal analysis can help minimize the guesswork and maximize your return on investment. Forecasting cash flows Financial forecasts typically … Read More

IRS: Indian Tribal Government Function

The IRS needs to improve the oversight supplied by its Indian Tribal Government (ITG) function, according to a recent audit. The Treasury Inspector General for Tax Administration recently looked at the effectiveness of the ITG in helping 574 federally recognized tribes plus related entities comply with tax law. In fiscal year 2018, the tribes had … Read More

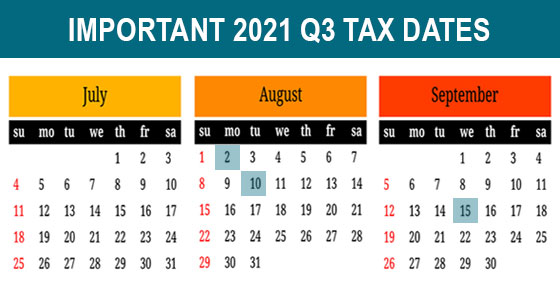

2021 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Monday, … Read More

IRS: Backup Withholding Tax

Do you receive payments that are subject to backup withholding tax? This is a federal tax (currently 24%) that applies to income (such as interest, dividends, gambling winnings, royalties and more) that doesn’t typically require tax withholding. The income recipient, however, must report and pay taxes on the income, and in some situations, the payer … Read More

Recordkeeping DOs and DON’Ts for business meal and vehicle expenses

If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet the strict substantiation requirements set forth under tax law. Tax auditors are adept at rooting … Read More

IRS: Delinquent Taxpayer Relief Over

The IRS has a message for delinquent taxpayers: The COVID-related pause in tax collection activities is over. The tax agency’s lien and levy programs have been kept idle since April 2020. But on June 15, 2021, letters started going out to taxpayers who failed to respond to prior notices. The letters inform taxpayers they have … Read More

CBO: Federal Estate and Gift Tax

The Congressional Budget Office (CBO) has published a report describing various aspects of federal estate and gift taxes. The report describes the taxes in detail, looks at the people who pay them and examines the types of assets that comprise taxable estates. In 2021, estates face a 40% tax rate on their value above $11.7 … Read More

Hiring your minor children this summer? Reap tax and nontax benefits

If you’re a business owner and you hire your children this summer, you can obtain tax breaks and other nontax benefits. The kids can gain on-the-job experience, spend time with you, save for college and learn how to manage money. And you may be able to: Shift your high-taxed income into tax-free or low-taxed income, … Read More

IRS: Wedding Season

It’s wedding season. While taxes may be the last thing on the minds of the happy couples, the IRS is reminding newlyweds of important details that could be overlooked. If there’s a name change, report it to the Social Security Administration (SSA) so that the names on tax returns match those the SSA has on … Read More