The holiday season is in full swing, and so are scams, warns the IRS. Con artists target taxpayers, possibly posing as IRS agents trying to collect bogus tax bills. They often demand payment by gift cards. Scammers may also claim a taxpayer’s identity has been stolen and used for criminal activity. These scams are usually … Read More

News

Accounting policies and procedures are essential for nonprofits, too

Financial reporting isn’t all about profits. Not-for-profit entities can also benefit from implementing formal accounting processes. From preparing budgets and monitoring financial results to paying invoices and handling payroll tax, there’s a lot that falls under the accounting umbrella. Are these tasks, and others, being managed as efficiently at your organization as they could be? … Read More

What to do if your CFO or controller leaves

A leadership departure in your accounting department can create turmoil, at least temporarily. However, it also provides an opportunity to assess the department’s performance and create a vision for how it should perform in the future. Here are four questions to address if your CFO or controller leaves. 1. Is the job description up to … Read More

Estate planning vocab 101: Executor and trustee

Among the many decisions you’ll have to make as your estate plan is being drafted is who you will appoint as the executor of your estate and the trustee of your trusts. These are important appointments, and, in fact, both roles can be filled by the same person. Let’s take a closer look at the … Read More

IRS: Student Loan Payment Pause

A student loan payment pause is extended through June 2023. On Nov. 22, President Biden announced that the U.S. Dept. of Education is extending the pause on student loan payments while Biden’s student loan relief plan is on hold following court rulings. The Biden Administration is asking the U.S. Supreme Court to take up the … Read More

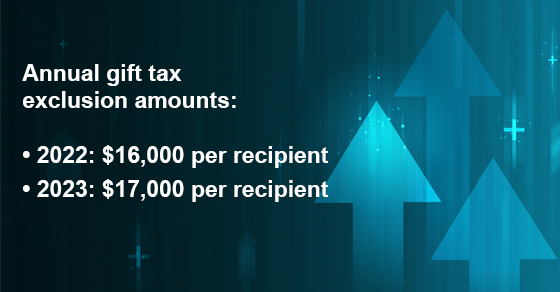

Annual gift tax exclusion amount increases for 2023

Did you know that one of the most effective estate-tax-saving techniques is also one of the simplest and most convenient? By making maximum use of the annual gift tax exclusion, you can pass substantial amounts of assets to loved ones during your lifetime without any gift tax. For 2022, the amount is $16,000 per recipient. … Read More

IRS: Roundtable Discussions

The U.S. Treasury Department recently conducted another roundtable discussion on how to improve accessibility and service quality at the IRS. These series of discussions are intended to help the IRS develop a strategic plan to modernize tax administration. Specifically, the conversation focused on the challenges underserved taxpayers face when trying to communicate with the IRS. … Read More

2023 limits for businesses that have HSAs — or want to establish them

No one needs to remind business owners that the cost of employee health care benefits keeps going up. One way to provide some of these benefits is through an employer-sponsored Health Savings Account (HSA). For eligible individuals, an HSA offers a tax-advantaged way to set aside funds (or have their employers do so) to meet … Read More

IRS: Whirlpool Case

The U.S. Supreme Court has refused a request by appliance manufacturer, Whirlpool to review a long-standing case. At issue is the treatment of Whirlpool’s 2009 earnings from its Luxembourg controlled foreign corporation, and whether branch rules applied to the income or U.S. Treasury regulations that taxpayers have relied upon for decades. In a tax blog, … Read More

Computer software costs: How does your business deduct them?

These days, most businesses buy or lease computer software to use in their operations. Or perhaps your business develops computer software to use in your products or services or sells or leases software to others. In any of these situations, you should be aware of the complex rules that determine the tax treatment of the … Read More