The White House has released a comprehensive guidebook to the Inflation Reduction Act’s clean energy and tax incentives. It provides an overview of related programs and explains who’s eligible to apply for funding and for what activities. For example, several provisions encourage businesses to invest in communities most in need of new economic development. Consumer … Read More

Author: Smeriglio Associates LLC

EU – Global Minimum Tax

The Global Minimum Tax is a done deal. On Dec. 12, 2022, the 27 members of the European Union (EU) unanimously agreed to implement the Organization for Economic Co-operation and Development’s tax framework. Until recently, Hungary had blocked the EU from moving ahead. But Hungary relented after the United States revoked its tax treaty. Now, … Read More

Instill family values with a FAST

You create an estate plan to meet technical objectives, such as minimizing gift and estate taxes and protecting your assets from creditors’ claims. But it’s also important to consider “softer,” yet equally critical, goals. These softer goals may include educating your children or other loved ones on how to manage wealth responsibly. Or, you may … Read More

IRS: 2022 Financial Report

The IRS has published its fiscal year 2022 financial report. The report highlights the agency’s fiscal actions and financial management activities for the period of Oct. 1, 2021, through Sept. 30, 2022. According to the report, during 2022, the IRS processed 260 million federal tax returns and other forms and collected $4.9 trillion in gross … Read More

IRS: Asset Deprecation Case

If you’re a business owner hoping to deduct asset depreciation from your gross income, it’s crucial to track the percentage of business use of assets. In one case, a married couple were long-time farmers. They deducted large amounts of depreciation on farm equipment and vehicles over several years, but they failed to track the business … Read More

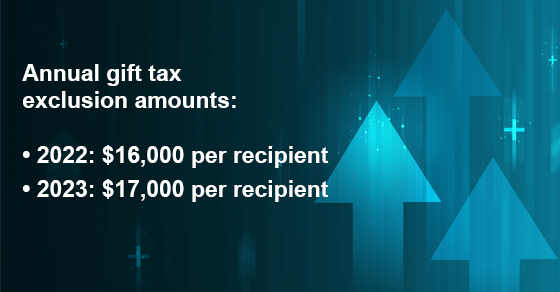

Annual gift tax exclusion amount increases for 2023

Did you know that one of the most effective estate-tax-saving techniques is also one of the simplest and most convenient? By making maximum use of the annual gift tax exclusion, you can pass substantial amounts of assets to loved ones during your lifetime without any gift tax. For 2022, the amount is $16,000 per recipient. … Read More

IRS: Social Security Tax Installment

If you own a business or are self employed and you deferred part of your Social Security tax in 2020, the second installment of the deferred amount is due Dec. 31, 2022. To pay, you can use the Electronic Federal Tax Payment System (EFTPS.gov). On the “type of tax” screen, choose “Deferred Social Security Tax” … Read More

Does your family business’s succession plan include estate planning strategies?

Family-owned businesses face distinctive challenges when it comes to succession planning. For example, it’s important to address the distinction between ownership succession and management succession. When a nonfamily business is sold to a third party, ownership and management succession typically happen simultaneously. However, in the context of a family business, there may be reasons to … Read More

2022 – 12/15 – IRS: Third Party Summons?

Must the IRS notify third parties when it summons bank records in an effort to collect a person’s unpaid taxes? Several circuit courts are divided over the issue and the U.S. Supreme Court has agreed to take it up. The Court will decide whether the IRS need only notify third parties if a delinquent taxpayer … Read More

Like every business, a start-up needs a sensible budget

An impressive 432,834 new business applications for tax identification numbers were submitted during October 2022, according to the U.S. Census Bureau. Indeed, despite the relatively higher costs of doing business these days, plenty of start-ups are still launching. One thing that every new company needs, along with a business plan, is a sensible budget. And that … Read More