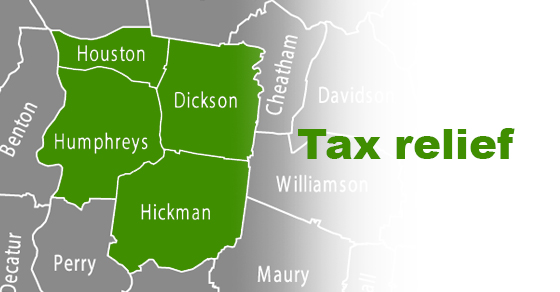

The IRS announces tax relief for victims of severe storms and flooding in Tennessee that occurred on Aug. 21, 2021. Individuals and businesses that reside, or have business premises, in Dickson, Hickman, Houston, and Humphreys counties qualify for the relief. They now have until Jan. 3, 2022, to file various individual and business tax returns … Read More

News

A tenancy-in-common interest can ease distribution of real estate

If your estate includes significant real estate investments, the manner in which you own these assets can have a dramatic effect on your estate plan. One versatile estate planning option to consider is tenancy-in-common (TIC) ownership. What is tenancy-in-common? A TIC interest is an undivided fractional interest in property. Rather than splitting the property into … Read More

IRS: No Longer Married or Sharing Residence

When taxpayers who filed joint tax returns are no longer married or no longer share a home, what happens if they owe delinquent tax? IRS collection activity must be disclosed to both parties, if requested. The Treasury Inspector General for Tax Administration (TIGTA) recently reviewed how well IRS staff followed disclosure rules. In 21% of … Read More

Expanding succession planning beyond ownership

Business owners are regularly urged to create and update their succession plans. And rightfully so — in the event of an ownership change, a solid succession plan can help prevent conflicts and preserve the legacy you’ve spent years or decades building. But if you want to take your succession plan to the next level, consider … Read More

Is your business underusing its accounting software?

Someone might have once told you that human beings use only 10% of our brains. The implication is that we have vast, untapped stores of cerebral power waiting to be discovered. In truth, this is a myth widely debunked by neurologists. What you may be underusing, as a business owner, is your accounting software. Much … Read More

2021 – 08/11 – IRS: ERC Safe Harbor

The IRS has provided a safe harbor for employers claiming the Employee Retention Credit (ERC). The safe harbor allows employers to exclude certain amounts from their gross receipts when determining their eligibility for the ERC. Specifically, Rev. Proc. 2021-33 allows employers to exclude the following amounts from gross receipts: the amount of the forgiveness of … Read More

Is an LLC the right choice for your small business?

Perhaps you operate your small business as a sole proprietorship and want to form a limited liability company (LLC) to protect your assets. Or maybe you are launching a new business and want to know your options for setting it up. Here are the basics of operating as an LLC and why it might be … Read More

IRS: Social Distancing and Precaution at IRS Offices

The IRS mostly scored well in surprise inspections for COVID-19 compliance, according to a new report. The Treasury Inspector General for Tax Administration (TIGTA) said the IRS “generally implemented health and safety measures to help protect individuals” working at the nine facilities inspected. All workers, regardless of vaccine status, wore required masks, though some wore … Read More

The deductibility of corporate expenses covered by officers or shareholders

Do you play a major role in a closely held corporation and sometimes spend money on corporate expenses personally? These costs may wind up being nondeductible both by an officer and the corporation unless proper steps are taken. This issue is more likely to arise in connection with a financially troubled corporation. Deductible vs. nondeductible … Read More

IRS: Financial Preparations in Natural Disasters

Protect your financial well-being in case of a natural disaster, warns the IRS. When disaster strikes, quick access to your personal records is crucial. While there’s time, follow these tips. Review and update your emergency plan annually. Create electronic copies of documents, such as bank statements, tax returns and insurance policies, and keep them in … Read More